Q3 2022 Statistical Data

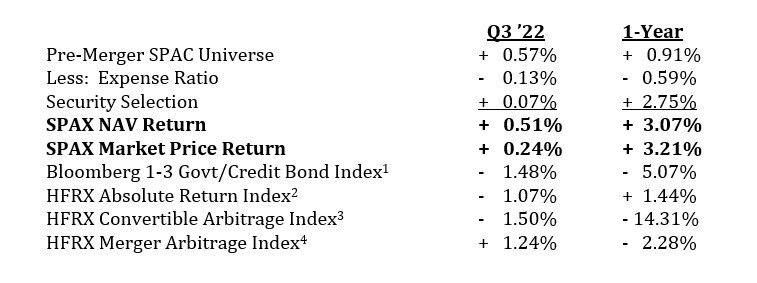

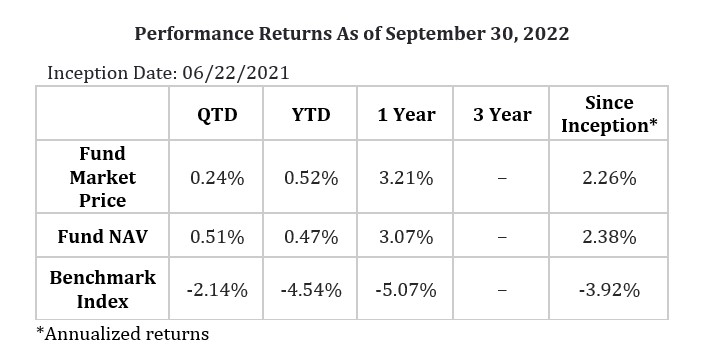

The Robinson Alternative Yield Pre-Merger SPAC ETF (ticker: SPAX) returned 0.24% for the third quarter of 2022 on a price basis and 3.21% for the trailing 1-year period; it returned 0.51% on a net asset value basis for the quarter and 3.07% for the 1-year period. Following is the Q3 2022 and trailing 1-year attribution analysis for the Fund’s NAV return relative to its benchmark index (Bloomberg 1-3 Year Govt/Credit Bond Index), as well as other absolute return and alternative yield strategies:

The total expense ratio for the Fund is 0.85%. The net expense ratio is 0.50%, based on a contractual waiver until 12/19/2023.

The performance data quoted above represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted above. Performance current to the most recent month-end can be found at robinsonetfs.com/.

Why Pre-Merger SPACs

The Fund invests exclusively in pre-merger Special Purpose Acquisition Companies (SPACs). The “pre-merger” phase of a SPAC’s life is the only time in which it behaves similar to a bond—it has a redemption date and a redemption value that is fully collateralized by T-Bills and/or Treasury Money Market funds. Our fund, SPAX, remains the only ETF that has specifically hard-coded into its prospectus that it intends to exit any SPAC prior to the completion of a merger. The intent of the Fund is to provide a higher yielding and less volatile alternative to absolute return strategies, traditional fixed income and/or other low volatility alternative yield strategies.

Fed Continues To Raise Rates

It was another challenging quarter for most public markets, and fixed income in particular. Prior to this year, the fund’s benchmark, the Bloomberg 1-3 Year Govt/Credit Index, went 45 years with only once generating two negative quarterly returns in a row—until now—Q3 2022 was its fourth consecutive negative quarterly return in a row. After raising short-term rates 0.25% in the first quarter, the Fed raised rates another 1.25% in the second quarter, and another 1.50% in the third quarter. There doesn’t appear to be a whole lot of relief in sight as the Fed Funds futures market is anticipating the Fed will raise short-term rates another 1.25% before year-end, as such, conditions could remain challenging for most traditional stock and bond markets.

Deal Announcement Rate Remains Consistent

We started the quarter with 588 SPACs looking for a merger partner. Given the aforementioned environment, it was a relatively quiet quarter in terms of new SPAC issuance, 8 new SPACs came to market in the third quarter. Despite the challenging environment and the crowded field of SPACs looking for a merger partner, there were 49 deal announcements during the quarter. Surprisingly, we have found little correlation between either the overall market environment, or the absolute number of SPACs in the market, and deal announcements. Throughout this challenging environment the deal announcement rate has remained pretty consistently in the 40-50 per quarter range. Once the field thins out some more we would expect new issuance to pick up—there are 107 sponsors who have filed but not yet come to market.

Opportunity On The Horizon

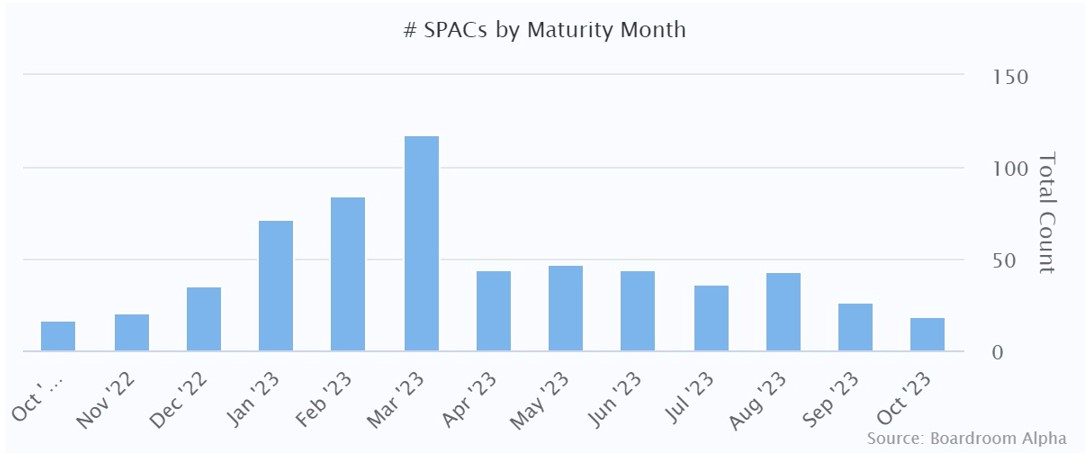

One of the new developments in the pre-merger SPAC market has been the increasing number of sponsors who have decided to abandon their search early and redeem out their shares. We had one such occurrence in the third quarter, but we have already seen a half dozen announcements early in the fourth quarter. This is a particularly positive development for those of us focused exclusively on pre-merger SPACs, as it simply shortens the time horizon for us to earn back the discount-to-trust value we purchased the SPACs. Of course, it has had the opposite impact on the SPAC warrant market, which only has value if a merger transaction is completed. As the chart below indicates, there is a huge glut of SPACs scheduled to mature in the first quarter of 2023. We would expect this group to be particularly susceptible to declaring an early redemption, as time is running out and market conditions are likely to remain challenging while the Fed continues to raise short-term interest rates to fight a 40-year high in inflation.

Why Now?

Few asset classes benefit from a hawkish Fed. Rising interest rates, as we saw the last three quarter, usually hurt most traditional stock and bond valuations. Given the Fed’s intent in raising short-term rates is to slow the economy, more often than not a Fed rate hike cycle has usually ended in an economic recession. Even if the tightening cycle doesn’t end in recession, a slowing economy typically puts further downward pressure on stock valuations and upward pressure on credit spreads. Treasury Bills and Treasury Money Market Funds (which pre-merger SPACs are required to invest) are among the few, if not only, assets that benefit from rising short-term rates without other consequences. At the beginning of this year the 3-month T-Bill was yielding 0.04%, it closed the third quarter with a yield of 3.27%. Following are what we believe are our top 5 reasons for WHY NOW for the Robinson Alternative Yield Pre-Merger SPAC ETF (SPAX):

- Potential Higher Yield: the cheapest 100 pre-merger SPACs offered an annualized discount-to-redemption value of 4.5% and the redemption value is growing as T-Bill yields increase. The forward T-Bill curve suggests T-Bills could return 3% annualized over the next 6 months. The total investment grade bond market, as measured by the Bloomberg Aggregate Bond Index, had a yield of 4.75% at quarter-end.

- Downside Mitigation: pre-merger SPACs have credit and interest rate risks similar to T-Bills (AAA rating), whereas the Bloomberg Aggregate Bond Index has an average credit quality rating of AA[1] (a notch below the credit rating of T-Bills) and a duration (a measure of a bond’s sensitivity to changes in interest rates) of 6.2 years (as an example, a hypothetical 1% rise in rates would mathematically produce a 6.2% price decline in the index).

- Upside Potential: as we saw in previous quarters, any merger announcement shortens the time for the SPAC to earn back its discount; and a positive market reaction to a merger announcement could potentially push SPAC prices well above their redemption values. SPACs deciding to redeem early also shorten the time horizon for us to earn back the discount at which we purchased them.

- Opportunity for Absolute Return: Pre-Merger SPACs bought at a discount can be held to redemption for an opportunity of an absolute return. At the end of the quarter, the equal weighted universe of pre-merger SPACs was trading at an annualized discount-to-redemption of 3.3% and an average time to maturity of 6 months; and, the redemption value will only increase (the forward curve estimates an increase of approximately 1%) with rising T-Bill yields.

- An Optional 40% Solution: we believe the potential for a higher yield, true downside mitigation, minimal interest rate or credit risk, and meaningful upside potential, provides a better 40% solution than traditional fixed income strategies.

[1] The Bloomberg 1-3 Yr Govt/Credit Index is a broad-based benchmark that measures the performance of investment grade, US dollar-denominated, fixed-rate Treasuries, government-related and corporate securities with 1 to 3 years to maturity.

[2] The HFRX Absolute Return Index measures the performance of absolute return hedge fund strategies that report their results to Hedge Fund Research.

[3] The HFRX Convertible Arbitrage Index measures the performance of convertible arbitrage hedge funds that report their results to Hedge Fund Research.

[4] The HFRX Merger Arbitrage Index measures the performance of merger arbitrage hedge fund strategies that report their results to Hedge Fund Research.

[5] S&P ratings represent Standard & Poor’s opinion on the general creditworthiness of a debtor, or the creditworthiness of a debtor with respect to a particular security or other financial obligation. Ratings are used to evaluate the likelihood a debt will be repaid and range from AAA (excellent capacity to meet financial obligations) to D (in default). In limited situations when the rating agency has not issued a formal rating, the security is classified as non-rated (NR).

DISCLOSURES

Investors should consider the investment objectives, risks, charges and expenses carefully before investing. For a prospectus or summary prospectus with this and other information about the Fund, click here. Read the prospectus or summary prospectus carefully before investing.

FUND RISKS

Investing involves risk. Principal loss is possible. ETFs may trade at a premium or discount to their net asset value. Brokerage commissions are charged on each trade which may reduce returns. A fund’s NAV is the sum of all its assets less any liabilities, divided by the number of shares outstanding. The market price is the most recent price at which the fund was traded.

The Fund invests in equity securities and warrants of SPACs, which raise assets to seek potential business combination opportunities. Unless and until a business combination is completed, a SPAC generally invests its assets in U.S. government securities, money market securities, and cash. Because SPACs have no operating history or ongoing business other than seeking a business combination, the value of their securities is particularly dependent on the ability of the entity’s management to identify and complete a profitable business combination. There is no guarantee that the SPACs in which the Fund invests will complete a business combination or will be profitable.

Some SPACs may pursue a business combination only within certain industries or regions, which may increase the volatility of their prices. To the extent a SPAC or the fund is invested in cash or cash equivalents, this may impact the ability of the Fund to meet its investment objective. Investments in a SPAC may be considered illiquid and subject to restrictions on resale.

The Fund may purchase warrants to purchase equity securities. Investments in warrants are pure speculation in that they have no voting rights and pay no dividends. They do not represent ownership of the securities, but only the right to buy them. Warrants involve the risk that the Fund could lose the purchase value of the warrant if the warrant is not exercised or sold prior to its expiration. The Fund may also purchase securities of companies that are offered in an IPO. The risk exists that the market value of IPO shares will fluctuate considerably due to factors such as the absence of a prior public market, unseasoned trading, a small number of shares available for trading and limited information about the issuer. Such investments could have a magnified impact on the Fund.

Some sectors of the economy and individual issuers have experienced particularly large losses due to economic trends, adverse market movements and global health crises. This may adversely affect the value and liquidity of the Fund’s investments especially since the fund is non-diversified, meaning it may invest a greater percentage of its assets in the securities of a particular, industry, or sector than if it was a diversified fund. As a result, a decline in the value of an investment could cause the Fund’s overall value to decline to a great degree.

The Fund is a recently organized management investment company with limited operating history and track record for prospective investors to base their investment decision.

The fund is distributed by Foreside Fund Services, LLC.